|

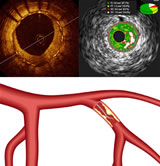

For the third quarter of 2009, the company reported a GAAP net loss of $4.0 million, or $0.08 per share, versus GAAP net income of $744,000, or $0.01 per diluted share, in the third quarter of 2008. Weighted average shares for the third quarter of 2009 were 48.5 million. Excluding stock-based compensation expense of $2.6 million and commissions of $1.4 million paid to a former distributor related to the company's transition to a direct sales initiative in Japan, the company reported non-GAAP net income of $7,000, or $0.00 per diluted share. In the third quarter of 2008, excluding stock-based compensation expense of $2.5 million, the company reported non-GAAP net income of $3.3 million, or $0.06 per diluted share. A reconciliation of the company's GAAP to non-GAAP results is included below. For the first nine months of 2009, Volcano reported revenues of $156.9 million, a 28 percent increase over revenues of $122.2 million in the same period a year ago. Revenues for the first nine months of 2009 include $12.2 million from Axsun. The company reported a GAAP net loss of $16.9 million, or $0.35 per share, compared with a GAAP net loss of $15.1 million, or $0.32 per share, in the same period year ago. Excluding stock-based compensation expense of $8.2 million and the aforementioned commissions of $1.4 million, Volcano reported a non-GAAP net loss of $7.3 million, or $0.15 per share, in the first nine months of 2009. Excluding in-process research and development costs of $12.4 million related to the Novelis and CardioSpectra transactions, $2.9 million in due diligence, legal and accounting expenses related to an acquisition that was not consummated, and stock-based compensation expense of $7.0 million, Volcano reported non-GAAP net income of $7.2 million, or $0.14 per diluted share, in the first nine months of 2008. "In addition to experiencing a very solid financial performance during the quarter, we completed our transition from our distributor relationship with Goodman to a direct sales effort in Japan and had new data demonstrating the value of our offerings presented at the recent Transcatheter Cardiovascular Therapeutics (TCT) meeting," said Scott Huennekens, president and chief executive officer. "During the quarter, our core intravascular ultrasound (IVUS) disposable sales increased 15 percent year-over-year, including 22 percent in Japan and 16 percent in the U.S. Our total functional measurement (FM) business increased 53 percent, led by year-over-year growth of more than75 percent in both the U.S. and Europe," Huennekens noted. "In Japan," he continued, "we have successfully completed our transition program with Goodman and converted all of their more than 400 accounts. We are also about halfway through our program to transition customers there to our s5 family of IVUS consoles. "Data from the key PROSPECT and FAME presentations at TCT demonstrated the value of our IVUS and FM offerings by providing evidence that diagnostic angiography alone is not enough and that the use of our devices can not only enhance patient care, but also have a meaningful impact on the cost of healthcare. We believe this data will help fuel further adoption of our current and future products," Huennekens concluded. 2009 Guidance The company continues to expect gross margin for the full year will be in the range of 59-60 percent, including additional depreciation of approximately $775,000 through the balance of the year related to the distributor transition in Japan. Operating expenses continue to be expected in the range of 67-69 percent, including stock-based compensation expense of approximately $12.0 million, intangible amortization of approximately $4.2 million and approximately $3.5 million in Goodman commissions. The outlook for operating expenses reflects increased spending in Japan, the expansion of sales and marketing programs in other geographies, G&A to support the growth of the company and litigation-related expenses. The company also expects a modest increase in research and development spending to fund product development programs, clinical trials and regulatory activities. The company continues to expect to report a GAAP net loss of $0.38-$0.43 per share. Excluding stock-based compensation expense of approximately $12.0 million and Goodman commissions of approximately $3.5 million, the company expects to report a net loss of $0.06-$0.11 per share. The company further noted that as previously reported, additional payments would be due to former CardioSpectra stockholders if one of the specific milestones in the acquisition agreement is met by the end of fiscal 2009 and the company would be required to make a milestone payment of approximately $11.0 million and record a one-time charge to in-process research and development. The impact of this charge, if it were to occur, would increase expectations for the range of loss per share from $0.38-$0.43 per share to $0.61-$0.66 per share. Weighted average shares outstanding at year-end 2009 are expected to be approximately 48.4 million basic shares and 50.0 million diluted shares. Conference Call Information About Volcano Corporation Non-GAAP Financial Measures Forward-Looking

Statements

VOLCANO CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

September 30, December 31,

2009 2008

---- ----

(unaudited)

Assets

Current assets:

Cash and cash equivalents $48,512 $100,949

Short-term available-for-sale investments 80,308 48,941

Accounts receivable, net 38,923 41,795

Inventories 36,457 28,936

Prepaid expenses and other current assets 5,492 5,869

----- -----

Total current assets 209,692 226,490

Restricted cash 553 327

Property and equipment, net 44,752 30,007

Intangible assets, net 12,624 15,636

Goodwill 931 842

Other non-current assets 2,041 2,177

----- -----

$270,593 $275,479

======== ========

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable $15,532 $14,867

Accrued compensation 12,841 12,690

Accrued expenses and other current liabilities 9,737 10,745

Deferred revenues 4,913 4,833

Short-term debt - 151

Current maturities of long-term debt 40 57

-- --

Total current liabilities 43,063 43,343

Long-term debt 9 34

Deferred revenues 2,028 1,914

Other 1,110 456

----- ---

Total liabilities 46,210 45,747

Stockholders' equity 224,383 229,732

------- -------

$270,593 $275,479

======== ========

VOLCANO CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

------------- -----------------

2009 2008 2009 2008

---- ---- ---- ----

Revenues $53,852 $44,118 $156,853 $122,242

Cost of revenues 21,778 16,581 64,913 45,915

------ ------ ------ ------

Gross profit 32,074 27,537 91,940 76,327

Operating expenses:

Selling, general and

administrative 28,272 19,546 79,805 62,405

Research and development 9,181 6,879 27,816 18,823

In-process research and

development - - - 12,407

Amortization of intangibles 1,058 786 3,163 2,337

----- --- ----- -----

Total operating expenses 38,511 27,211 110,784 95,972

------ ------ ------- ------

Operating (loss) income (6,437) 326 (18,844) (19,645)

Interest income 142 1,109 640 4,206

Interest expense (1) (2) (4) (8)

Exchange rate gain (loss) 2,419 (441) 2,162 1,091

----- ---- ----- -----

(Loss) income before provision

for income taxes (3,877) 992 (16,046) (14,356)

Provision for income taxes 121 248 833 707

--- --- --- ---

Net (loss) income $(3,998) $744 $(16,879) $(15,063)

======= ==== ======== ========

Net (loss) income per share:

Basic $(0.08) $0.02 $(0.35) $(0.32)

====== ===== ====== ======

Diluted $(0.08) $0.01 $(0.35) $(0.32)

====== ===== ====== ======

Shares used in calculating net

loss per share:

Basic 48,506 47,456 48,293 47,236

====== ====== ====== ======

Diluted 48,506 50,323 48,293 47,236

====== ====== ====== ======

VOLCANO CORPORATION

RECONCILIATION OF GAAP RESULTS TO NON-GAAP RESULTS

(in thousands, except per share data)

(Unaudited)

Three Nine

Months Ended Months Ended

September 30, September 30,

------------- -------------

2009 2008 2009 2008

---- ---- ---- ----

GAAP operating (loss) income $(6,437) $326 $(18,844) $(19,645)

Stock-based compensation 2,597 2,513 8,162 6,997

In-process research and

development - - - 12,407

Acquisition due-diligence

costs - - - 2,878

Commissions paid under

Distributor Termination

Agreement 1,408 - 1,408 -

----- --- ----- ---

Non-GAAP operating (loss)

income $(2,432) $2,839 $(9,274) $2,637

======= ====== ======= ======

GAAP net (loss) income $(3,998) $744 $(16,879) $(15,063)

Stock-based compensation 2,597 2,513 8,162 6,997

In-process research and

development - - - 12,407

Acquisition due-diligence

costs - - - 2,878

Commissions paid under

Distributor Termination

Agreement 1,408 - 1,408 -

----- --- ----- ---

Non-GAAP net income (loss) $7 $3,257 $(7,309) $7,219

== ====== ======= ======

GAAP net (loss) income per

share-basic $(0.08) $0.02 $(0.35) $(0.32)

Stock-based compensation 0.05 0.05 0.17 0.15

In-process research and

development - - - 0.26

Acquisition due-diligence

costs - - - 0.06

Commissions paid under

Distributor Termination

Agreement 0.03 - 0.03 -

---- --- ---- ---

Non-GAAP net income (loss) per

share-basic $0.00 $0.07 $(0.15) $0.15

===== ===== ====== =====

Shares used in calculating net

income (loss) per share-

basic 48,506 47,456 48,293 47,236

====== ====== ====== ======

GAAP net (loss) income per

share-diluted $(0.08) $0.01 $(0.35) $(0.32)

Stock-based compensation 0.05 0.05 0.17 0.14

In-process research and

development - - - 0.25

Acquisition due-diligence

costs - - - 0.06

Commissions paid under

Distributor Termination

Agreement 0.03 - 0.03 -

Adjustment to shares used in

calculating net income per

share - - - 0.01

--- --- --- ----

Non-GAAP net income (loss) per

share-diluted $0.00 $0.06 $(0.15) $0.14

===== ===== ====== =====

Shares used in calculating net

income (loss) per share-

diluted 50,599 50,323 48,293 49,859

====== ====== ====== ======

VOLCANO CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP FORWARD LOOKING GUIDANCE

(in thousands, except per share data)

(Unaudited)

2009

----

Guidance Range

--------------

From To

---- --

GAAP net loss per share-basic

and diluted $(0.38) $(0.43)

Stock-based compensation 0.25 0.25

Commissions paid under

Distributor Termination

Agreement 0.07 0.07

---- ----

Non-GAAP net loss per share-

basic and diluted $(0.06) $(0.11)

====== ======

Shares used in calculating net

loss per share-basic and

diluted 48,400 48,400

====== ======

VOLCANO CORPORATION

REVENUE SUMMARY

(in millions)

(Unaudited)

Three Nine

months ended Percentage months ended Percentage

September 30, Change September 30, Change

------------- ----------- ------------- -----------

2008 2008

to to

2009 2008 2009 2009 2008 2009

---- ---- ---- ---- ---- ----

Medical segment:

IVUS systems:

United

States $5.6 $5.6 1% $16.7 $15.3 9%

Japan 0.1 2.5 (94) 1.5 4.9 (70)

Europe 2.1 1.8 14 5.8 5.4 9

Rest of

world 0.6 0.7 (15) 2.1 1.9 9

--- --- --- ---

Total IVUS

systems $8.4 $10.6 (20) $26.1 $27.5 (5)

IVUS disposables:

United

States $15.1 $13.0 16% $44.4 $37.6 18%

Japan 10.8 8.9 22 31.8 24.7 29

Europe 4.6 4.6 0 13.6 13.0 4

Rest of

world 0.8 0.7 10 2.4 2.2 9

--- --- --- ---

Total IVUS

disposables $31.3 $27.2 15 $92.2 $77.5 19

FM:

United

States $4.1 $2.3 76% $11.7 $6.3 86%

Japan 0.2 0.5 (64) 0.9 0.9 (3)

Europe 3.1 1.7 77 7.7 5.1 51

Rest of

world 0.2 0.4 (41) 0.9 0.8 6

--- --- --- ---

Total FM $7.6 $4.9 53 $21.2 $13.1 61

Other 2.4 1.4 67% 6.2 4.1 50%

--- --- --- ---

Sub-total

medical

segment $49.7 $44.1 13 $145.7 $122.2 19

Telecom segment 4.2 - - 11.2 - -

--- --- ---- ---

Total $53.9 $44.1 22 $156.9 $122.2 28

===== ===== ====== ======

Source: Volcano Corporation |