|

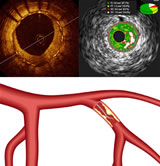

For the second quarter of 2010, the company reported record net income on a GAAP basis of $5.4 million, or $0.10 per diluted share, versus a GAAP net loss of $5.3 million, or $0.11 per share, in the second quarter of 2009. Excluding stock-based compensation and in-process research and development expense of $3.1 million, the company reported net income of $8.6 million, or $0.16 per diluted share, in the second quarter of 2010. Excluding stock-based compensation expense of $2.9 million, the company reported a net loss of $2.4 million, or $0.05 per share, in the second quarter of 2009. For the first six months of 2010, Volcano reported revenues of $140.0 million, a 36 percent increase over revenues of $103.0 million in the same period a year ago. The company reported GAAP net income of $1.4 million, or $0.03 per diluted share, in the first six months of 2010. This compares with a GAAP net loss of $12.9 million, or $0.27 per share, in the same period in 2009. Excluding stock-based compensation and in-process research and development expense of $6.3 million, Volcano reported net income of $7.6 million, or $0.14 per diluted share, in the first six months of 2010. In the first six months of 2009, excluding stock-based compensation expense of $5.6 million, Volcano reported a net loss of $7.3 million, or $0.15 per share. "We continued to drive growth in both our intravascular ultrasound (IVUS) and Functional Measurement (FM) businesses, which grew 25 and 51 percent year-over-year, respectively. In the quarter, overall IVUS disposable revenues increased 29 percent versus the prior year, and our FM business increased 50 percent in both the U.S. and Europe," said Scott Huennekens, president and chief executive officer. "During the quarter, we introduced significant enhancements to our IVUS and FM disposables and our multi-modality console operating software, and commenced the European launch of our VIBE RX Vascular Imaging Catheter. In addition, we completed a number of cases utilizing the latest version of our Optical Coherence Tomography (OCT) catheter and system," he added. Volcano also announced today that it has signed a definitive agreement to acquire Fluid Medical Inc., a privately held company that is developing advanced catheter-based forward-looking imaging technology, for $4.2 million in cash. The company expects to close the transaction next week. There are no additional royalty or milestone payments to stockholders of Fluid Medical associated with the transaction. "This transaction represents another milestone in the expansion of our multi-modality platform strategy to create competitive differentiation for Volcano. We are acquiring technology and IP providing a forward field of view imaging on highly maneuverable catheters that have the potential to enable or enhance visualization for procedures currently done with inadequate imaging," noted Huennekens. "This technology is expected to result in a Forward-Looking Intra-Cardiac Echo (FL.ICE) catheter that will initially be focused on minimally invasive structural heart applications, such as percutaneous aortic and mitral valve therapies," he added. Guidance for 2010 The company expects that gross margins in 2010 will continue to be in the range of 62-63 percent. Operating expenses for all of 2010 are expected to be in the range of 58-60 percent of revenues. The expectations for operating expenses include increased research and development costs related to development of the Fluid Medical technology and increased litigation expenses. Net interest income is expected to be approximately $400,000 versus previous expectations of $450,000. The company expects earnings per share for all of 2010 will continue to be in the range of $0.05-$0.10 per diluted share. The company expects that weighted average shares on a diluted basis at the end of 2010 will be approximately 53 million. The company continues to expect that excluding stock-based compensation expense, net income will be $0.30-$0.35 per diluted share. Conference Call Information About Volcano Corporation Non-GAAP Financial Measures Forward-Looking Statements

VOLCANO CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

June 30, December 31,

2010 2009

---- ----

(unaudited)

Assets

Current assets:

Cash and cash equivalents $50,628 $56,055

Short-term available-for-

sale investments 76,970 66,028

Accounts receivable, net 52,015 51,171

Inventories 39,245 37,710

Prepaid expenses and other

current assets 4,717 5,892

Total current assets 223,575 216,856

Restricted cash 575 554

Long-term available-for-sale

investments 3,788 -

Property and equipment, net 45,376 44,734

Intangible assets, net 12,560 11,623

Goodwill 931 931

Other non-current assets 2,038 2,036

$288,843 $276,734

======== ========

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable $12,508 $13,840

Accrued compensation 13,088 14,142

Accrued expenses and other

current liabilities 12,217 25,275

Deferred revenues 5,047 4,881

Current maturities of long-

term debt 50 50

Total current liabilities 42,910 58,188

Long-term debt 85 110

Deferred revenues 2,561 2,376

Other 1,431 1,245

Total liabilities 46,987 61,919

Stockholders' equity 241,856 214,815

------- -------

$288,843 $276,734

======== ========

VOLCANO CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

-------- --------

2010 2009 2010 2009

---- ---- ---- ----

Revenues $73,452 $54,042 $140,024 $103,001

Cost of revenues 27,093 22,486 53,731 43,135

------ ------ ------ ------

Gross profit 46,359 31,556 86,293 59,866

Operating

expenses:

Selling, general

and

administrative 30,082 26,453 63,161 51,533

Research and

development 9,594 9,866 19,452 18,635

In-process

research and

development 33 - 65 -

Amortization of

intangibles 621 1,053 1,194 2,105

Total operating

expenses 40,330 37,372 83,872 72,273

------ ------ ------ ------

Operating income

(loss) 6,029 (5,816) 2,421 (12,407)

Interest income 83 197 168 498

Interest expense (11) (1) (18) (3)

Exchange rate

(loss) gain (423) 871 (544) (257)

Other (9) - (19) -

--- --- --- ---

Income (loss)

before provision

for income taxes 5,669 (4,749) 2,008 (12,169)

Provision for

income taxes 253 518 628 712

--- --- --- ---

Net income (loss) $5,416 $(5,267) $1,380 $(12,881)

====== ======= ====== ========

Net income (loss)

per share:

Basic $0.11 $(0.11) $0.03 $(0.27)

===== ====== ===== ======

Diluted $0.10 $(0.11) $0.03 $(0.27)

===== ====== ===== ======

Shares used in

calculating net

income (loss) per

share:

Basic 50,452 48,335 50,099 48,184

====== ====== ====== ======

Diluted 53,071 48,335 52,876 48,184

VOLCANO CORPORATION

RECONCILIATION OF GAAP RESULTS TO NON-GAAP RESULTS

(in thousands, except per share data)

(Unaudited)

Three Months Six Months

Ended Ended

June 30, June 30,

-------- --------

2010 2009 2010 2009

---- ---- ---- ----

GAAP operating income

(loss) $6,029 $(5,816) $2,421 $(12,407)

Stock-based compensation 3,108 2,850 6,191 5,565

In-process research and

development 33 - 65 -

Non-GAAP operating income

(loss) $9,170 $(2,966) $8,677 $(6,842)

====== ======= ====== =======

GAAP net income (loss) $5,416 $(5,267) $1,380 $(12,881)

Stock-based compensation 3,108 2,850 6,191 5,565

In-process research and

development 33 - 65 -

Non-GAAP net income

(loss) income $8,557 $(2,417) $7,636 $(7,316)

====== ======= ====== =======

GAAP net income (loss) per

share-basic $0.11 $(0.11) $0.03 $(0.27)

Stock-based compensation 0.06 0.06 0.12 0.12

In-process research and

development - - - -

Non-GAAP net income

(loss) per share-basic $0.17 $(0.05) $0.14 $(0.15)

===== ====== ===== ======

Shares used in calculating

net income (loss) per

share-basic 50,452 48,335 52,876 48,184

====== ====== ====== ======

GAAP net income (loss) per

share-diluted $0.10 $(0.11) $0.03 $(0.27)

Stock-based compensation 0.06 0.06 0.12 0.12

In-process research and

development - - - -

Non-GAAP net income

(loss) per share-diluted $0.16 $(0.05) $0.14 $(0.15)

===== ====== ===== ======

Shares used in calculating

net income (loss) per

share-diluted 53,071 48,335 52,876 48,184

====== ====== ====== ======

VOLCANO CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP FORWARD LOOKING GUIDANCE

(in thousands, except per share data)

(Unaudited)

2010

----

Guidance Range

--------------

From To

---- ---

GAAP operating income $5,230 $7,883

Stock-based compensation expense 13,100 13,100

Non-GAAP operating income $18,330 $20,983

======= =======

GAAP net income $2,654 $5,308

Stock-based compensation expense 13,100 13,100

Non-GAAP net income $15,754 $18,408

======= =======

GAAP net income per share-diluted $0.05 $0.10

Stock-based compensation 0.25 0.25

Non-GAAP net income per

share-diluted $0.30 $0.35

===== =====

Shares used in calculating net income

per share-diluted 53,077 53,077

====== ======

VOLCANO CORPORATION

REVENUE SUMMARY

(in millions)

(unaudited)

Percentage

Three Months Ended Change

June 30, ----------

--------

2009 to

2010 2009 2010

---- ---- --------

Medical segment:

Consoles:

United States $7.3 $6.1 20%

Japan 0.1 0.2 (49)

Europe 2.0 2.2 (11)

Rest of world 1.4 0.8 65

Total Consoles $10.8 $9.3 16

IVUS single-procedure

disposables:

United States $17.1 $14.9 15%

Japan 17.3 11.0 57

Europe 5.2 5.0 5

Rest of world 1.3 0.8 53

Total IVUS single-

procedure disposables $40.9 $31.7 29

FM single-procedure

disposables:

United States $6.0 $4.0 50%

Japan 0.7 0.4 67

Europe 3.7 2.5 50

Rest of world 0.4 0.3 17

Total FM single-procedure

disposables $10.8 $7.2 49

Other $4.3 2.2 93%

Sub-total medical segment $66.8 $50.4 32

Industrial segment $6.7 3.6 84

Total $73.5 $54.0 36

===== =====

Percentage

Six Months Ended Change

June 30, ----------

--------

2009 to

2010 2009 2010

---- ---- --------

Medical segment:

Consoles:

United States $11.5 $11.1 4%

Japan 1.3 1.3 0

Europe 3.9 3.9 0

Rest of world 2.7 1.5 79

Total Consoles $19.4 $17.8 9

IVUS single-procedure

disposables:

United States $33.4 $28.7 16%

Japan 33.2 21.0 58

Europe 10.5 9.0 17

Rest of world 2.4 1.7 45

Total IVUS single-

procedure disposables $79.5 $60.4 32

FM single-procedure

disposables:

United States $11.3 $7.6 48%

Japan 1.5 0.7 116

Europe 7.7 4.5 69

Rest of world 0.8 0.6 37

Total FM single-procedure

disposables $21.3 $13.4 58

Other $8.0 4.4 83%

Sub-total medical segment $128.2 $96.0 34

Industrial segment $11.8 7.0 68

Total $140.0 $103.0 36

====== ======

Source: Volcano Corporation |